Core competencies

The board regularly evaluates director qualifications and core competencies in the context of the board’s oversight of strategic initiatives, financial and operational performance objectives, and material risks. To that end, the board seeks directors whose collective knowledge, experience and skills provide a broad range of perspectives and leadership expertise in domains particularly relevant to our business, including: highly complex and regulated industries, strategic planning, financial strategy, utility/energy industry, technology and security, audit oversight and financial controls, human capital management, corporate governance, sustainability matters (including those associated with climate strategy), public policy, and other areas important to executing WEC Energy Group’s strategy.

With that in mind, the Corporate Governance Committee and board have determined that the board’s composition should consist of candidates who collectively possess a specific set of core competencies, as defined below, to effectively carry out its oversight function.

Senior leadership/CEO experience

Directors who have significant senior leadership experience as a CEO or senior executive demonstrate a practical understanding of an organization and its operational processes, enterprise risks and strategy, and are able to recognize leadership skills in others.

Risk management and oversight

Directors with expertise in risk management and oversight can provide keen insights that are critical to the company as it manages comprehensive practices and policies used to effectively identify and mitigate risks that arise across every area of the organization.

Strategic planning

Amid unprecedented business and technological innovation and transformation, the company must continue to maximize its financial and operational performance. Directors with expertise in strategic planning can help management identify ways to adjust its strategy in response to the changing environment, while maintaining long-term value creation.

Corporate governance

The company strives to maintain and promote a framework of practices and policies through which the board can assure stakeholders of the company’s accountability and transparency. It is important to have directors with strong expertise in corporate governance practices who work alongside management to ensure the board maintains its focus on stockholder interests.

Financial strategy/investment management/investor relations

It is important that our directors have expertise in evaluating financial plans, policies and strategies, including capital structure, debt programs and equity financings. Directors with an understanding of investments and investment-making policy add significant value in assessing investment approaches and performance.

Audit oversight/financial reporting

Directors with expertise in financial reporting, internal controls and audit functions are critical to effective oversight of the company’s accurate preparation of financial statements and disclosures, and of compliance with legal and regulatory requirements.

Sustainability matters

Our company is focused on serving our customers and supporting our communities as a responsible corporate citizen, which includes a commitment to improving our environmental performance and reducing potential negative impacts of our operations on the environment. Directors who have experience overseeing, operating and/or advising on sustainability matters, including those associated with climate risk, provide valuable input to strategic decision making as we seek to create long-term value for all of our key stakeholders.

Human capital management/executive compensation

Our company operates in a highly technical and complex industry that necessitates a strong focus on talent management. Directors with experience in acquiring new talent, establishing a competitive compensation and benefit package, and succession planning are critical to the company’s ability to implement strategies aimed at attracting and retaining human capital.

Government/public policy

Directors who have experience working with government organizations and public policy provide valuable input as management considers the strategic impact of new and changing legislative acts and policies, as well as judicial decisions that affect the utility industry.

Regulated industry knowledge

Our businesses are heavily regulated and directly affected by multiple state and federal regulatory agencies. These regulations significantly influence the company’s operating environment and its financial condition. Directors with experience in highly regulated businesses bring relevant context to discussions on the strategic impact of these regulations.

Utility/energy industry experience

Directors who have leadership and operational experience in our industry bring a practical understanding of the technical nature of the company’s business, which allows for thoughtful deliberation in discussing the intricacies of achieving operational excellence.

Technology and security

The industry in which our company conducts business is complex and experiencing ongoing transformation. Digital and other technological advances are changing energy policy and markets, as well as creating new sources of risk that challenge the protection of systems and assets against physical and cyber threats. The company has identified the importance and value of having directors with knowledge in these areas.

Assessing board competencies

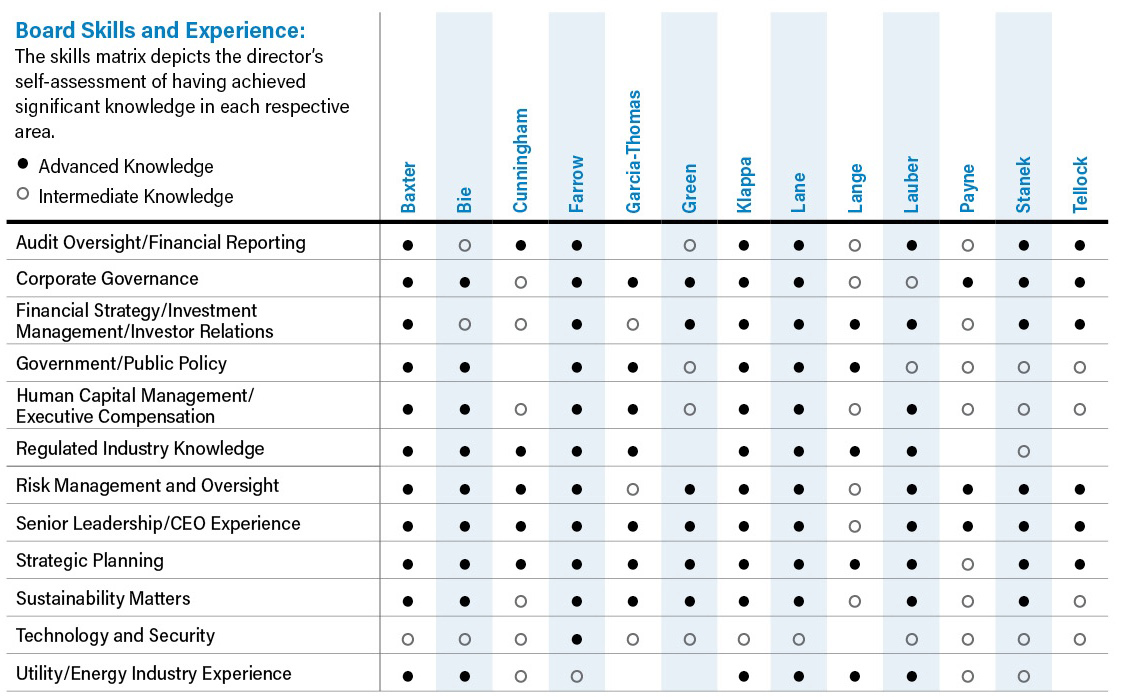

During the fourth quarter of 2024, the Corporate Governance Committee and board evaluated and affirmed this set of competencies. Each director performed a self-assessment of their level of knowledge in each skill area using the following 3-point scale: “1” Limited knowledge (e.g., no direct experience, primary exposure comes from board or committee reports); “2” Intermediate knowledge (e.g., general managerial/oversight experience or broad exposure as a board or committee member); “3” Advanced knowledge (e.g., direct experience, subject matter expert). A summary of the board’s level of knowledge with respect to each of the core competencies is shown in the following table.